Features

Business

Flowers

Marketing

Nursery

Retail

What consumers want: Growing the garden centre shopping experience

What do consumers look for at garden retail? This study reveals the true role of pricing, the most sought-after plant features, and key elements of the ideal shopping experience.

May 3, 2022 By Dr. Amy Bowen

The study presented a number of ornamental plant types to surveyed consumers who indicated their most valued plant features. photo courtesy of MayaAfzaal/GETTY

The study presented a number of ornamental plant types to surveyed consumers who indicated their most valued plant features. photo courtesy of MayaAfzaal/GETTY Independent garden centres (IGC) have seen a boom in business over the past several years. With consumers restricted in their activities and travel having been almost non-existent, many homeowners turned to gardening as a way to stay active and release stress.

Research studies completed during the pandemic found that one in five Canadians started a garden in 2020. They also found that gardening is attracting a new segment of younger consumers, and there is increased interest in buying online as garden centres offer more services such as delivery and curbside pickup.

In fact, 89 per cent of IGCs in Canada and the U.S. reported an increase in sales over the past two years. Statistics Canada reported $1.68 billion in the sale of plants and flowers in 2020, marking a 10-year high.

The combined impact of increased sales and new customers provides a tremendous opportunity for keeping consumers engaged and to develop long-term home gardening habits. With this in mind, researchers from the Consumer, Sensory & Market Insights team at Vineland Research and Innovation Centre as well as the Department of Marketing and Consumer Studies at the University of Guelph embarked on a multi-year research project to understand the path to purchasing for Canadian garden centre consumers.

Price is not the main deciding factor

The first part of the study, completed in the fall of 2020, aimed to understand the role of pricing in nursery plant purchasing decisions and to explore the plant qualities and garden centre factors considered by consumers when purchasing a plant.

The qualitative study of 44 garden centre shoppers in southern Ontario, British Columbia and Saskatchewan found that consumers engaged in a multi-stage path to purchase. The first step is the planning stage where consumers identify the dimensions and the look of the plant they want to purchase. The second step is deciding where to make the purchase; higher commitment plants require more investment of time, and consumers carefully consider the location and knowledge of retail staff at various locations. The third step is going to the garden centre; consumers select their store, browse, consult staff and compile a short list of options with price generally being an afterthought. The final step is the purchase once they are confident in their selection.

Based on consumer feedback, 64 per cent of respondents said they shop exclusively at IGCs because they value the knowledgeable staff, quality and diverse selection. When making their selection, consumers indicated that their top features were plant dimensions (34 per cent), plant aesthetics such as colour and shape (32 per cent) and plant vitality or a healthy appearance (31 per cent). Only 7 per cent indicated price as the main consideration.

Further prodding on the issue found that 68 per cent of shoppers either didn’t notice the price, or they made an assessment and found the price to be fair. Only 30 per cent of shoppers said they paid attention to pricing and made price comparisons. In addition to product cost being an afterthought, only 16 per cent of shoppers made an impulse purchase while at the IGC. This number is surprisingly low when compared to grocery stores where the impulse purchase rate is 80 per cent. It could mean that few garden centre customers make unplanned purchases, perhaps due to a lack of space or purpose in mind for the plant.

The most valuable plant features

The second part of the study sought to understand which plant features consumers value most and would potentially pay a premium for.

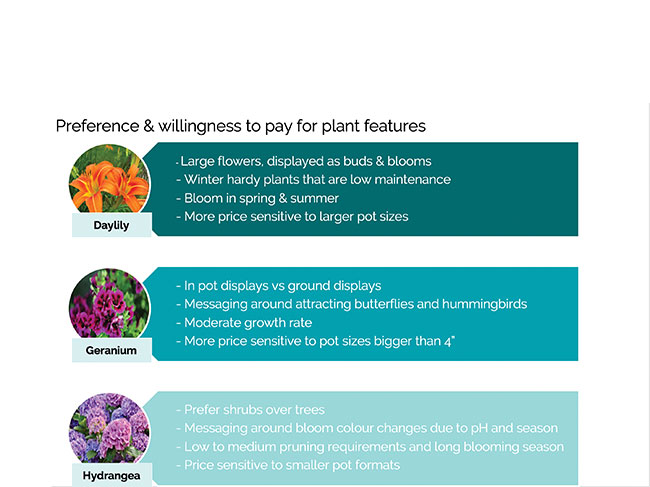

678 participants from Canada and the U.S. completed an online questionnaire in the summer of 2021. All participants were over 18 years of age and had purchased one or more plants in the past 12 months. Three plant types were selected for consumer feedback: geranium to represent an annual flower, daylily to represent a perennial flower and hydrangea to represent a shrub/tree. Participants were randomly divided into three groups and each group evaluated the features of one plant type. Preferred features and willingness to pay by plant types were as follows.

- Geranium: Consumers preferred and were willing to pay more for geraniums when displayed in pots with messaging indicating a moderate growth rate, full sun light requirements and attractiveness to butterflies and hummingbirds. They were more price-sensitive to pot sizes greater than four inches.

- Daylily: Consumers preferred and were willing to pay more for daylilies that were low maintenance, had large flowers and displayed buds and blooms. Canadian consumers also preferred and were willing to pay more for winter hardiness and blooms in the spring and summer. U.S. consumers were more price-sensitive to the one-gallon pot size, whereas Canadian consumers were more price sensitive to one- and two-gallon pot sizes.

- Hydrangea: Consumers preferred and were willing to pay more for hydrangeas as shrubs versus trees. They were also drawn to those identified as having low to medium pruning requirements, medium to long bloom times and bloom colour changes due to pH and season. Canadian consumers were more price-sensitive to smaller pot formats whereas U.S. consumers were more price-sensitive to the five-gallon pot size.

Overall, key features identified for each plant type can be used to engage with consumers, manage inventory and create plant displays and messaging based on preferred features.

The third part of the study explored the online versus in-store retail experience to understand shopping features most important to consumers. Qualitative interviews of 17 garden centre shoppers were completed at three IGCs in southern Ontario in August 2021. Shoppers were asked to share the most important aspects of their shopping experience.

The ideal shopping experience

For in-store shopping, 94 per cent of consumers said being able to see plants, along with access to garden centre customer service and consultation, were the most important features. The shopping process itself was also important, with 65 per cent of consumers stating that being able to walk around and compare plants was important to the in-store experience. Typically, consumers who enjoy an in-store experience are actively looking for a variety of plant options, personalized advice, along with deals and promotions. The biggest challenge to in-store shopping, as stated by 24 per cent of surveyed consumers, was the difficulty in finding the items they were looking for and the lack of inventory.

As for the online shopping experience, 88 per cent of consumers said they cared most about being able to see actual plant photos with descriptions and care instructions, not just stock images. Similarly, this was the largest deterrent for 71 per cent of those who wanted to be able to see and inspect the plants to determine their size and quality. Other advantages of online purchasing included the convenience of shopping from home with 24-hour access, along with the ability to easily search for products (if they know the plants by name).

Key takeaways

As an IGC, how can you apply this knowledge to your business? Here are a few recommendations:

- Create an inviting culture. IGC consumers are, for the most part, true hobbyists. They choose to shop at your location because they appreciate the experience of being at the garden centre. They enjoy interacting with the staff and seek their advice and knowledge in making purchase decisions. Use this to your advantage and invest in your employees to provide the best in-store and online shopping experience. Your staff and customers can be advocates of your business and be the reason for both new and returning customers.

- Encourage impulse buying. In general, impulse purchasing at garden centres is low. Why not have plant care information in close proximity to the plants? By creating a convenient one-stop shopping experience, consumers can purchase their plants and pick up pruning shears, gloves or plant fertilizers to increase their gardening success rate. This enhances their overall experience while increasing your sales.

- Create zones to promote plant features valued by consumers. With so many new home gardeners taking up the hobby, why not set up areas in your garden centre to highlight plants with specific features, particularly ones valued by consumers? Try creating an area featuring cold-hardy plants for your region. Or how about including signage for plants that attract pollinators? Other options include creating areas to highlight low maintenance products, or setting up an expert area to challenge consumers’ green thumbs. The possibilities are endless.

Acknowledgements

This research was supported through the American Floral Endowment’s Floral Marketing Fund, as well as the Canadian Nursery Landscape Association, Landscape Ontario and Garden Centres Canada.

Members of the research team included

Dr. Amy Bowen, Dr. Alexandra Grygorczyk and Mithun Shrivastava of Vineland Research and Innovation Centre, as well as Dr. Juan Wang and MSc candidate Xuezhu (Nicole) Wang from the University of Guelph.

Amy Bowen, PhD, is the Director of Consumer, Sensory and Market Insights at Vineland Research and Innovation Centre. Contact her at amy.bowen@vinelandresearch.com.

Print this page